Unlock Exclusive Advantages With a Federal Cooperative Credit Union

Federal Credit report Unions use a host of special advantages that can substantially influence your financial health. From boosted savings and examining accounts to reduced rate of interest rates on finances and customized financial planning solutions, the advantages are tailored to aid you save money and achieve your financial goals more effectively. But there's even more to these benefits than simply monetary rewards; they can additionally provide a complacency and neighborhood that surpasses typical financial services. As we discover even more, you'll discover exactly how these one-of-a-kind advantages can truly make a difference in your economic trip.

Membership Qualification Criteria

To come to be a participant of a government credit score union, people should satisfy specific qualification requirements established by the institution. These standards differ relying on the particular cooperative credit union, however they commonly consist of variables such as geographical area, employment in a specific market or firm, subscription in a specific company or association, or family members partnerships to existing participants. Federal lending institution are member-owned economic cooperatives, so qualification needs are in area to guarantee that individuals who join share a typical bond or organization.

Improved Financial Savings and Checking Accounts

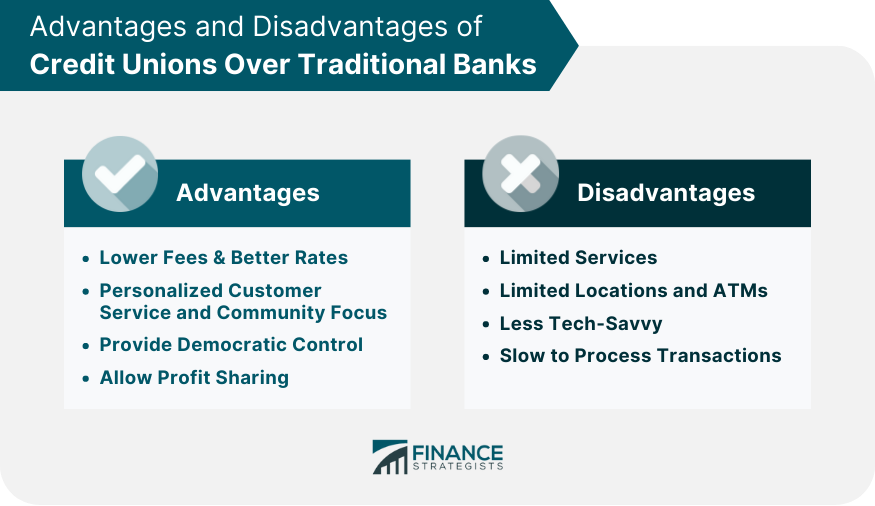

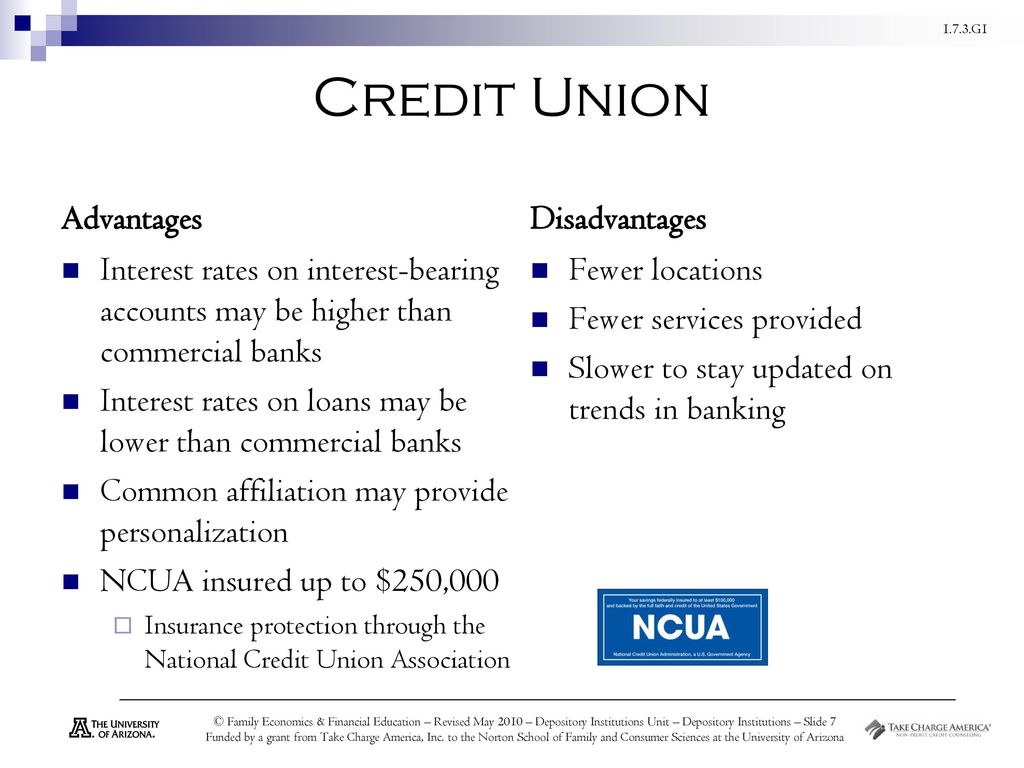

With improved financial savings and examining accounts, government cooperative credit union use participants premium financial products developed to maximize their finance strategies. These accounts typically feature higher rates of interest on financial savings, lower fees, and additional advantages contrasted to conventional banks. Participants can enjoy features such as competitive dividend rates on cost savings accounts, which assist their money expand faster over time. Examining accounts might provide advantages like no minimum balance requirements, cost-free checks, and atm machine fee compensations. In addition, federal cooperative credit union generally offer online and mobile banking services that make it convenient for members to monitor their accounts, transfer funds, and pay costs anytime, anywhere. By making use of these improved financial savings and inspecting accounts, members can optimize their savings potential and successfully handle their daily funds. This emphasis on providing costs financial items sets government cooperative credit union apart and demonstrates their dedication to aiding members attain their monetary goals.

Reduced Rate Of Interest on Loans

Federal credit rating unions offer participants with the benefit of reduced rates of interest on lendings, allowing them to borrow cash at even more cost effective terms compared to other economic institutions. This benefit can cause considerable cost savings over the life of a financing. Lower rate of interest imply that consumers pay less in passion costs, reducing the total price of loaning. Whether participants require a loan for an auto, home, or individual expenditures, accessing funds via a government credit union can cause a lot more favorable repayment terms.

Personalized Financial Preparation Solutions

Given the concentrate on boosting members' financial well-being through reduced rate of interest rates on loans, government cooperative credit advice union likewise offer individualized financial preparation solutions to assist people in attaining their long-lasting financial goals. These personalized solutions satisfy participants' specific demands and scenarios, providing a tailored approach to economic planning. By evaluating revenue, expenditures, obligations, and possessions, federal lending institution economic planners can aid members produce a comprehensive financial roadmap. This roadmap may consist of methods for saving, investing, retirement preparation, and debt management.

Additionally, the individualized monetary planning solutions used by government lending institution usually come with a reduced cost contrasted to private monetary advisors, making them more obtainable to a broader variety of people. Participants can gain from specialist advice and competence without incurring high costs, straightening with the debt union ideology of prioritizing participants' monetary well-being. Overall, these solutions aim to empower participants to make educated financial decisions, construct wealth, and safeguard their monetary futures.

Accessibility to Exclusive Member Discounts

Members of federal cooperative credit union appreciate special accessibility to a variety of member discount rates on numerous services and products. Wyoming Federal Credit Union. These price cuts are a valuable perk that can help members save money on day-to-day expenditures and special purchases. Federal cooperative credit union frequently companion with retailers, company, and various other companies to use discounts solely Home Page to their members

Participants can gain from discounts on a range of products, consisting of electronic devices, apparel, travel bundles, and a lot more. In enhancement, solutions such as auto rentals, resort reservations, and home entertainment tickets might additionally be readily available at affordable prices for lending institution members. These unique price cuts can make a substantial distinction in members' budgets, permitting them to enjoy cost savings on both necessary products and high-ends.

Verdict

In conclusion, joining a Federal Credit history Union offers various advantages, consisting of improved cost savings and examining accounts, reduced rates of interest on fundings, customized monetary planning solutions, and accessibility to exclusive member discount rates. By view it becoming a participant, people can gain from a variety of financial perks and solutions that can aid them conserve cash, plan for the future, and reinforce their connections to the regional community.

Comments on “Credit Unions Cheyenne WY: Comprehensive Financial Solutions for Locals”